Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Home › Uncategorized › Nationwide SmartMiles Review (2024)Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to .

Written by Jeffrey ManolaLicensed Insurance Agent

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina.

Reviewed by Jeff RootLicensed Insurance Agent

UPDATED: Aug 6, 2024

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Aug 6, 2024

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Our Nationwide SmartMiles review covers everything you need to know about this pay-per-mile auto insurance coverage, from pros and cons to coverage options. We also recommend reading our Nationwide auto insurance review for more information about the company as a whole.

Read on to learn more about Nationwide SmartMiles coverage. You can also enter your ZIP code into our free quote comparison tool to get started on finding the cheapest pay-per-mile car insurance.

Things to RememberNationwide SmartMiles has numerous positive points, such as:

The main cons of Nationwide SmartMiles, however, are the following:

Continue reading to learn more about how SmartMiles works and if it’s right for you.

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

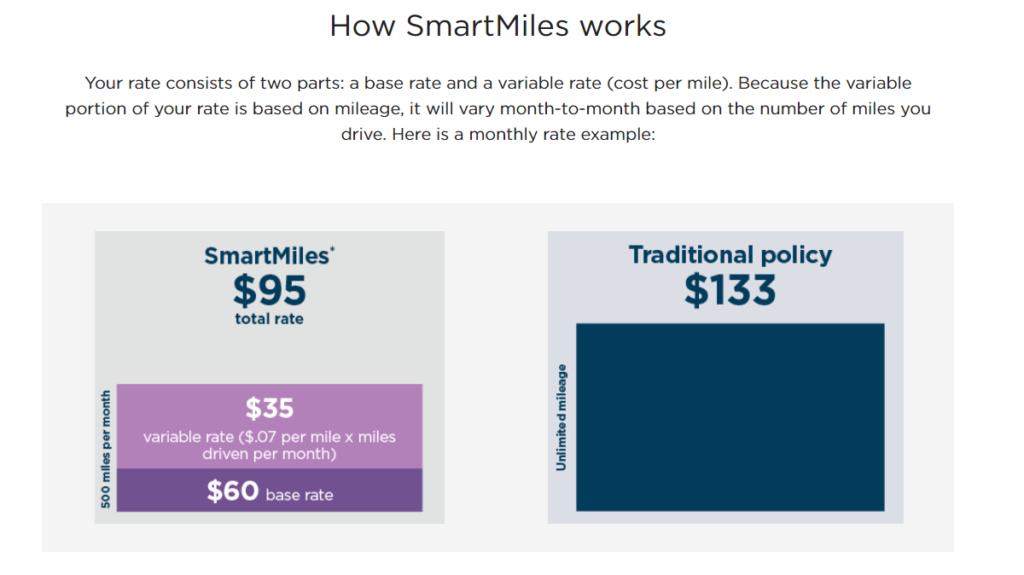

Nationwide SmartMiles charges drivers a base rate for coverage and then a per-mile rate for each mile driven, making it great auto insurance for telecommuters.

You will always pay your base rate, but because you pay for car insurance by the mile, your final bill will fluctuate monthly depending on your total mileage.

Furthermore, Nationwide SmartMiles is an innovative program designed for drivers who want to pay for their car insurance based on the actual miles they drive. This program offers flexibility and potential cost savings, making it an attractive option for those who drive infrequently.

To learn more about this program, contacting Nationwide auto insurance customer service can provide you with detailed information on the benefits and features of SmartMiles. For assistance with any questions or to manage your policy, calling the Nationwide auto insurance phone number is an efficient way to get support.

Nationwide also offers various services to cater to specific needs. For example, if you’re a classic car enthusiast, Nationwide provides specialized classic car coverage tailored for vintage and collectible vehicles.

Additionally, tools like the Nationwide car plug can help track your driving habits, allowing for more accurate rate adjustments based on your actual usage. To save on premiums, you can take advantage of promotions and use a Nationwide discount code.

Moreover, for drivers looking for flexible payment options, Nationwide pay-as-you-go allows you to manage your insurance costs according to how much you drive, ensuring you’re only paying for what you use.

To activate Nationwide SmartMiles, you will first need to start by getting a Nationwide SmartMiles quote and signing up for coverage. Then, Nationwide will send you a small plug-in device to track your mileage.

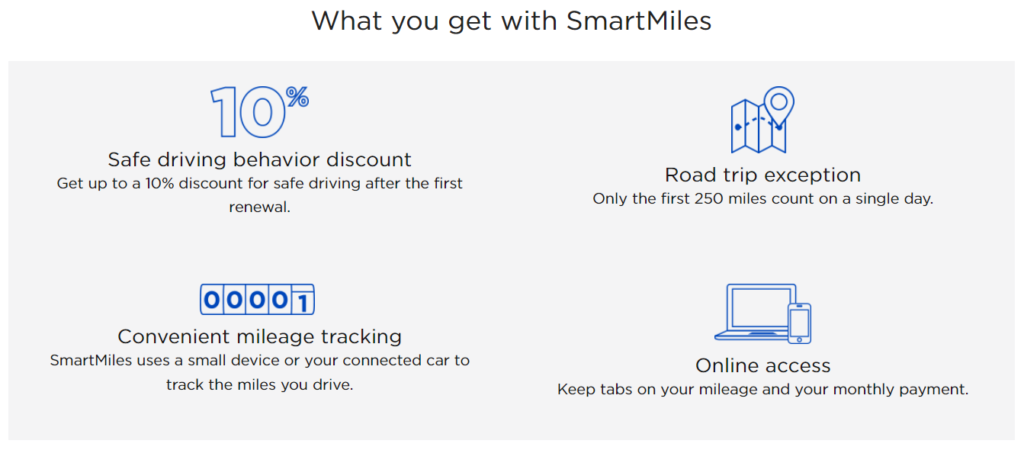

Once the device is installed, Nationwide will track your mileage and base your rates accordingly. While there is no Nationwide SmartMiles app, you can check your rates online at any time or contact Nationwide SmartMiles customer service.

Moreover, activating Nationwide SmartMiles is a simple process that allows drivers to save on their car insurance based on actual mileage driven. One significant advantage of this program is the Nationwide low-mileage discount, which offers savings for policyholders who drive fewer miles.

To start using SmartMiles, you need to install the Nationwide milewise device in your vehicle. This device tracks the number of miles you drive, helping to calculate your insurance rates accordingly. For those who drive infrequently, Milewise car insurance provides an excellent opportunity to enjoy lower premiums due to reduced usage.

In addition to SmartMiles, Nationwide offers the SmartRide program. This program not only monitors your mileage but also evaluates your driving habits, potentially leading to discounts for safe driving practices. To see how other users have benefited from the program, you can check out a Nationwide SmartRide review for detailed feedback and experiences.

To manage your SmartRide account and track your driving data, you can easily access the Nationwide SmartRide login portal. Both SmartMiles and SmartRide are great options for drivers looking to save money while encouraging responsible driving behavior.

The Nationwide SmartMiles device tracks mileage every time you drive. During the first policy period, Nationwide SmartMiles will also track driving behavior data, such as speeding and time of day. It will then use this driving data to calculate a safe driving discount of up to 10% for your next renewal.

Programs like SmartMiles are the best car insurance for low-mileage drivers who rarely drive or the best auto insurance for limited-use vehicles.

Also, Nationwide SmartMiles is a specialized insurance program offering Nationwide pay-per-mile options, ideal for drivers who don’t cover extensive distances. The program uses a device installed in your car to track mileage, making the Nationwide insurance smartmiles system highly accurate in determining your premium based on actual usage. T

his system is particularly advantageous for drivers in states like California, where California pay-per-mile car insurance can provide substantial savings due to the state’s often congested roads and high driving costs. As one of the best pay-per-mile car insurance options, SmartMiles ensures that you pay for what you use, providing a tailored insurance experience that reflects your driving habits.

This is a prime example of by-mile insurance, where the cost of your insurance is directly linked to the number of miles you drive.

The key to Nationwide SmartMiles is in what it tracks: the total number of miles driven. This data is crucial as it directly influences your insurance premium, ensuring that you are charged fairly based on your actual driving behavior. For low-mileage drivers, this Nationwide pay-per-mile approach can result in significantly lower insurance costs compared to traditional insurance plans.

By offering this form of by-mile insurance, Nationwide allows customers to manage their insurance expenses more effectively, making it an attractive option for those looking to save on auto insurance.

This transparency and customization appeal to budget-conscious drivers who want to ensure they are only paying for the coverage they need, making Nationwide SmartMiles a smart choice for managing auto insurance costs efficiently.

Nationwide SmartMiles is pay-per-mile auto insurance coverage, whereas SmartRide is a telematics program that tracks driving data for a safe driver discount. Take a look at the main differences between the two below.

Nationwide SmartMiles vs. SmartRide: Compare the Differences| Features | SmartMiles | SmartRide |

|---|---|---|

| Policy Add-On | No | Yes |

| Tracking | Mileage | Driving Behavior |

| Availability | 40 States | All States |

| Discount | Up to 18% | 30% |

| Monthly Rates | $110 | $75 |

You can read more about SmartRide in our Nationwide SmartRide app review.

Furthermore, when comparing Nationwide SmartMiles and SmartRide, it’s important to understand the benefits and target users of each program, particularly if you’re looking for the cheapest pay-per-mile insurance. SmartMiles is a drive-by-mile car insurance option, which is perfect for those who drive infrequently.

It aligns with the growing trend among insurance companies that charge by the mile, providing an affordable solution for drivers who cover less ground. For instance, pay-per-mile car insurance in Georgia can offer significant savings for people who do not use their vehicles daily.

According to many Nationwide pay-per-mile reviews, customers appreciate the transparency and cost-effectiveness of SmartMiles, as they only pay for the miles they drive, making it an ideal choice for low-mileage drivers.

On the other hand, SmartRide is designed to reward safe driving habits, not just low mileage. While SmartMiles is auto insurance based on miles driven, SmartRide monitors driving behaviors such as speed, hard braking, and the time of day when driving occurs.

This program offers discounts for safe driving, making it suitable for those who might drive more frequently but exhibit cautious driving patterns. For those who prioritize car insurance based on how much you drive, SmartMiles is generally more beneficial, as it directly links insurance costs to the number of miles driven.

In contrast, SmartRide may be a better fit for drivers who seek rewards for their safe driving practices, regardless of the distance they travel. Deciding between the two depends on whether your primary goal is to reduce costs through limited driving or to gain discounts by driving safely.

Nationwide SmartMiles offers all the same coverages as traditional Nationwide auto insurance policies, so drivers can choose between liability-only and full coverage policies, as well as numerous add-ons. However, rates will be different than Nationwide traditional policies.

Full coverage provides the best coverage for drivers, and programs like Nationwide SmartMiles can make full coverage more affordable for low-mileage drivers.

Dani Best Licensed Insurance Producer

While you will need to get a Nationwide SmartMiles quote to determine exactly what you will pay, you can expect to pay a base rate of under $100 per month for coverage and then a per-mile fee of under $0.10.

In addition, Nationwide SmartMiles offers a flexible and cost-effective solution for drivers seeking car insurance for cars that are not driven often. This program is perfect for those who need car insurance for limited use, as it calculates premiums based on the actual miles driven.

By focusing on low-mileage car insurance, SmartMiles allows drivers to save significantly if they do not frequently use their vehicles. For instance, in a 500-mile example, a driver who only uses their car for short commutes or occasional errands would benefit greatly, paying much less than they would with traditional insurance plans.

For those searching for the cheapest car insurance for low-mileage drivers, SmartMiles stands out as one of the best pay-as-you-go car insurance options. It provides competitive rates for individuals who drive less, making it an excellent choice for retirees, telecommuters, or anyone who doesn’t use their car regularly.

With SmartMiles, you only pay for the miles you drive, ensuring that your insurance costs accurately reflect your usage. This approach offers a transparent and fair way to manage car insurance expenses, aligning your costs with your specific driving habits and needs.

Because Nationwide SmartMiles is already heavily discounted auto insurance for low-mileage drivers, it doesn’t offer as many discounts. The main discount Nationwide SmartMiles offers is a safe driver discount of up to 10% for good drivers.

Subsequently, Nationwide SmartMiles offers significant advantages for drivers looking for a discount for low mileage on auto insurance. This program is ideal for those who drive infrequently, as it provides low-mileage auto insurance rates that reflect their actual usage.

By offering a low-mileage car insurance discount, SmartMiles rewards drivers who use their cars less frequently with reduced premiums. This is part of the broader trend toward mileage-based car insurance, where your insurance costs are directly related to the number of miles you drive.

Additionally, SmartMiles provides a flexible drive-as-you-go insurance option, which ensures that your payments are based on your real driving habits. This is particularly beneficial for drivers of smaller vehicles who might be interested in microcar insurance.

By adopting a mileage-based approach, SmartMiles aligns insurance costs with actual driving patterns, offering a fair and transparent pricing structure. This model not only helps in saving money for those who drive less but also supports a more accurate reflection of driving habits in insurance premiums.

Curious how Nationwide SmartMiles stacks up against other providers of cheap usage-based auto insurance? Take a look below to see how SmartMiles compares to mileage and driving behavior programs from other top auto insurance companies.

Compare Pay-Per-Mile Auto Insurance by Provider| Company | Program | Tracking Method | Monitoring | Availability | Potential Savings | Monthly Rate |

|---|---|---|---|---|---|---|

| Allstate | Milewise | Plug-in device | Mileage | 21 states | 15% | $124 |

| American Family | DriveMyWay | Mobile app | Driving behavior | Utah only | 20% | $100 |

| Geico | DriveEasy | Mobile app | Driving behavior | 33 states | 25% | $110 |

| Liberty Mutual | RightTrack | Plug-in device | Driving behavior | 41 states | 30% | $120 |

| Nationwide | SmartMiles | Plug-in device | Mileage | 45 states | 20% | $110 |

| Noblr | Noblr | Mobile app | Driving behavior | 10 states | 15% | $120 |

| Progressive | Snapshot | Mobile app | Driving behavior | 12 states | 30% | $135 |

| Root | Root | Mobile app | Driving behavior | 34 states | 25% | $130 |

| State Farm | Drive Safe & Save | Plug-in & mobile | Mileage & driving | 49 states | 30% | $130 |

| Travelers | Intellidrive | Plug-in device | Driving behavior | 38 states | 20% | $120 |

Nationwide is one of the more widely established mileage-based auto insurance, as it is offered in most states.

Additionally, Nationwide SmartMiles excels as a leading mile-based insurance company, offering significant advantages for drivers based on their actual mileage. For those seeking car insurance for driving less than 50 miles a day in Florida, SmartMiles provides a cost-effective solution by tailoring premiums to low-mileage usage.

This is particularly useful for individuals in Florida who prefer pay-as-you-go car insurance in Florida, as it ensures that insurance costs are directly related to the miles driven. With SmartMiles, drivers benefit from a flexible and fair pricing model that aligns their insurance expenses with their specific driving habits, making it a standout choice in mileage-based insurance.

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Nationwide SmartMiles is one of the better providers of auto insurance for infrequent drivers, as it is widely available and offers an additional discount for safe driving.

Additionally, when considering Nationwide SmartMiles, it’s essential to understand how it fits into the broader landscape of pay-by-mile auto insurance. SmartMiles operates as an auto insurance based on miles driven, where your premium is directly related to the distance you travel.

This approach is particularly beneficial for those seeking pay-per-mile car insurance in New York, as it offers a cost-effective solution for drivers who don’t use their vehicles extensively. Milewise reviews often highlight the advantages of such mileage-based insurance programs, noting their effectiveness in providing savings for low-mileage drivers.

A distinctive feature of Nationwide SmartMiles is its pricing structure, which includes a base rate portion and a variable cost that fluctuates with your mileage.

This means that while you pay a fixed amount, your total premium adjusts according to the miles you drive, aligning with the concept of Nationwide pay-per-mile insurance. This model offers a fair and transparent approach to auto insurance, making SmartMiles a strong choice for those interested in mileage-based insurance solutions that reflect their actual driving patterns.

While some drivers may have privacy concerns due to their data being tracked, SmartMiles has some of the best car insurance for low-mileage drivers looking to save, as it offers all the coverages of a normal policy.

Want to find low-mileage savings today? Enter your ZIP into our free tool for quote comparisons.

Yes, Nationwide offers pay-per-mile auto insurance with Nationwide SmartMiles.

Nationwide SmartMiles is available in all states except for the following: AK, HI, LA, NC, NY, and OK.

Yes, Nationwide uses Telematics with its SmartMiles program. It will track your mileage with a plug-in device, and you can view your mileage and rates at any time on the Nationwide SmartMiles app.

Nationwide SmartMiles tracks mileage to see how many miles are driven. It will also track speed, time of day driven, and more during your first policy period to issue a safe driving discount.

Yes, Nationwide SmartMiles tracks driving behavior during the first policy period to calculate a safe driving discount of up to 10%.

Nationwide SmartMiles tracks mileage, but during the first policy period, it will also collect driving behavior data to issue a safe driving discount at your next renewal.

Generally, the best annual mileage for cheap insurance is under 8,000 miles per year. The less you drive, the cheaper your Nationwide SmartMiles quote will be (read more: Does annual mileage affect auto insurance rates?).

With Nationwide SmartMiles, a device or connected car will automatically track your mileage. Learn more in our guide on how to get a low mileage auto insurance discount.

Both are pay-per-mile insurance programs offered by different companies. While both work similarly, the main difference between the two is that Nationwide SmartMiles is offered in more states than Allstate Milewise, making SmartMiles more accessible.

Nationwide SmartMiles is one of the best pay-per-mile car insurance providers, as few companies offer low-mileage auto insurance, but take a look at our list of the best pay-as-you-go auto insurance companies to see if there is one that better fits your auto insurance needs.

The number of miles driven in a month can vary widely based on personal driving habits. For example, some people might drive only a few hundred miles, while others might drive thousands. Knowing your monthly mileage is important when selecting insurance, especially if you’re considering options like pay-by-mile auto insurance.

It is not recommended to try to cheat SmartRide. This program monitors your driving habits, including speed and braking, using a mobile app or device. Attempting to manipulate or deceive the system can lead to penalties, higher rates, or cancellation of your policy. It’s best to focus on safe driving practices to benefit from the program’s discounts.

If you rarely drive your car, consider mile-based auto insurance options. Programs like Nationwide SmartMiles are designed for infrequent drivers, as they base premiums on the number of miles you actually drive. This can be a cost-effective way to insure a vehicle that isn’t used often.

Nationwide car insurance can be a good option for many drivers, offering a range of coverage choices and benefits. With programs like Nationwide SmartMiles, it caters to low-mileage drivers by providing insurance that reflects actual driving patterns. It’s worth exploring if it meets your specific needs.

Pay-by-mile insurance can be worth it if you drive infrequently. This type of insurance calculates your premium based on the miles you drive, potentially saving you money compared to traditional insurance plans. It’s especially beneficial if you have low mileage and want to pay only for the coverage you use.

Nationwide SmartRide tracks various aspects of your driving through an app or device, including acceleration, braking, and driving times. This data helps evaluate your driving behavior and may provide discounts based on safe driving practices.

Mile-based auto insurance is a type of insurance where your premium is determined by the number of miles you drive. This approach is beneficial for drivers who don’t travel long distances, as it allows them to pay for insurance based on their actual driving usage.

SmartRide is a Nationwide program that uses a mobile app or device to monitor and assess your driving behavior. It tracks metrics like speed and braking to offer potential discounts on your insurance premium based on safe driving habits.

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption